By Eric Singular, Director, Hemp Business Journal

While the global food supply chain has been shaken by crop shortages, the COVID-19 pandemic, and more logistical disruptions due to the Russian invasion of Ukraine, the plant-based foods market has shown remarkable resilience, and the hemp sector is looking to establish the grain as a superfood.

A reported 4 in 10 Americans are buying plant-based meat and/or dairy products, with most doing so on a regular basis. According to the Plant Based Foods Association (PBFA), the trend spiked last year as 2021 U.S. retail sales of plant-based food reached $7.4 billion, up 6.2% from 2020, and marking a 27% increase from 2019. The strong consumer interest is attributed to an emphasis on health, wellness, and sustainability since the pandemic, opening an opportunity for hemp as a highly nutritious whole grain.

A recent report from the PBFA, in conjunction with the Good Food Institute and SPINS, highlights the newfound popularity of plant-based foods. In 2021, 79 million (62%) among U.S. households purchased plant-based products, with 78% of purchasers being repeat buyers.

Hemp for Nutrition

While Canada-based Manitoba Harvest has cultivated a robust supply chain from seed to shelf – becoming the world’s largest hemp heart brand – they are promoting hemp grain as an ingredient for formulation to boost the nutritional value of a vast array of food products. Since the plant-based food category already relies heavily on pea protein, the premise is that hemp fits the bill of a superfood to compete head-on with other common plant-based nutritional additives.

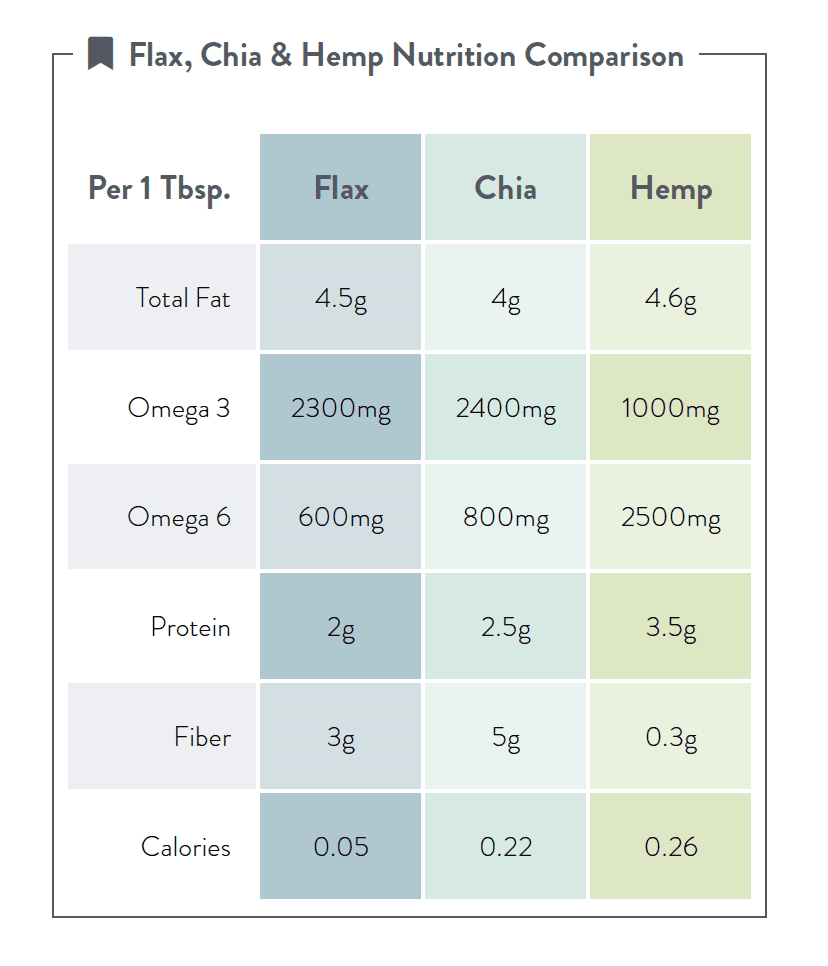

While some studies have found a high variability in hempseed composition through its genotypes and environmental factors, it typically contains between 25%–35% lipids, 20%–25% proteins, and 20%–30% carbohydrates as well as vitamins and minerals. Moreover, it is not an international allergen, thus broadening its potential consumer appeal to those trying to avoid soy, lactose, or gluten.

While some studies have found a high variability in hempseed composition through its genotypes and environmental factors, it typically contains between 25%–35% lipids, 20%–25% proteins, and 20%–30% carbohydrates as well as vitamins and minerals. Moreover, it is not an international allergen, thus broadening its potential consumer appeal to those trying to avoid soy, lactose, or gluten.

Plant-Based Milk

Milk alternatives lead the plant-based market, serving as the growth engine for the entire milk category. In 2021, animal-based milk’s sales declined by $264 million across the category. The same year, plant-based milk sales grew 4%, reaching a category value of $2.6 billion. In conventional grocery stores, 16% of all retail milk sales were plant-based.

Almond milk accounts for 59% of the total category’s market share, followed by oat milk’s growth to become the second-largest segment, now comprising 17% of category sales (up from 0.5% in 2018, marking a 3,300% increase in the past three years). While the almond and oat products have a huge lead on hemp milk, the latter is highly nutritious. Compared to rice or almond milk, hemp milk has more protein and polyunsaturated fats (i.e., “healthy fats”). Compared to whole cow’s milk, hemp milk offers fewer calories, less protein, and reduced carbs, but an equivalent amount of fat.

Hemp milk companies like Tempt use aseptic packaging methods to increase the shelf life of products by up to 18 months without the need for refrigeration or other preservatives. A June 2021 report by Persistence Market Research projected the global hemp seed milk market to reach a value of $415 million by 2031, growing at a compound annual growth rate (CAGR) of 11%. Ingredient innovation is driving the plant-based milk category, as best exemplified by significant consumer adoption of oat milk. As PBFA notes, all that is required in the process for making plant-based milk is the liquifying of nutrients from a wide array of plant sources. Thus, the varieties and blends of plant-based milk are virtually limitless. As formulators continue to research and develop the taste, solubility, and texture of hemp milk, its adoption could be spurred.

Plant-Based Meat

Meat and milk are the categories spearheading the growth of the plant-based foods market. While conventional meat unit sales have grown 9% in the past three years, plant-based meat unit sales have outpaced that rate by nearly 6x, growing 51% over the same period. In 2021, plant-based meat sales topped $1.4 billion.

According to Kentucky-based Victory Hemp Foods, hemp grain’s qualities make it a highly suitable ingredient for formulation in plant-based meat products. The company’s specially formulated V-70

Victory Hemp Foods contends that their V-70 product contains 70% protein with all 9 essential amino acids, while also providing a rich source of iron, magnesium, and zinc. Further, it is high in Edestin (the primary protein in egg whites) and Arginine (an essential amino acid for infants and seniors) while having low-fat content, including the ideal (roughly 3:1) ratio of omega-6 to omega-3 fatty acids.

While plant-based burgers lead the plant-based meat category, strong consumer desire exists for more variety. In 2021, the fastest-growing plant-based meat product types included meatballs, chicken cutlets, nuggets, and tenders, and deli slices.

Cost remains among consumers’ primary considerations. Against rising inflation, unit sales of plant-based meat were slightly down, and animal-based meat dropped significantly. As noted in the 2022 Power of Meat report from the Food Industry Association (FMI), high prices for animal-based meats led consumers to shop for them less frequently.

Beyond Plant-Based Foods

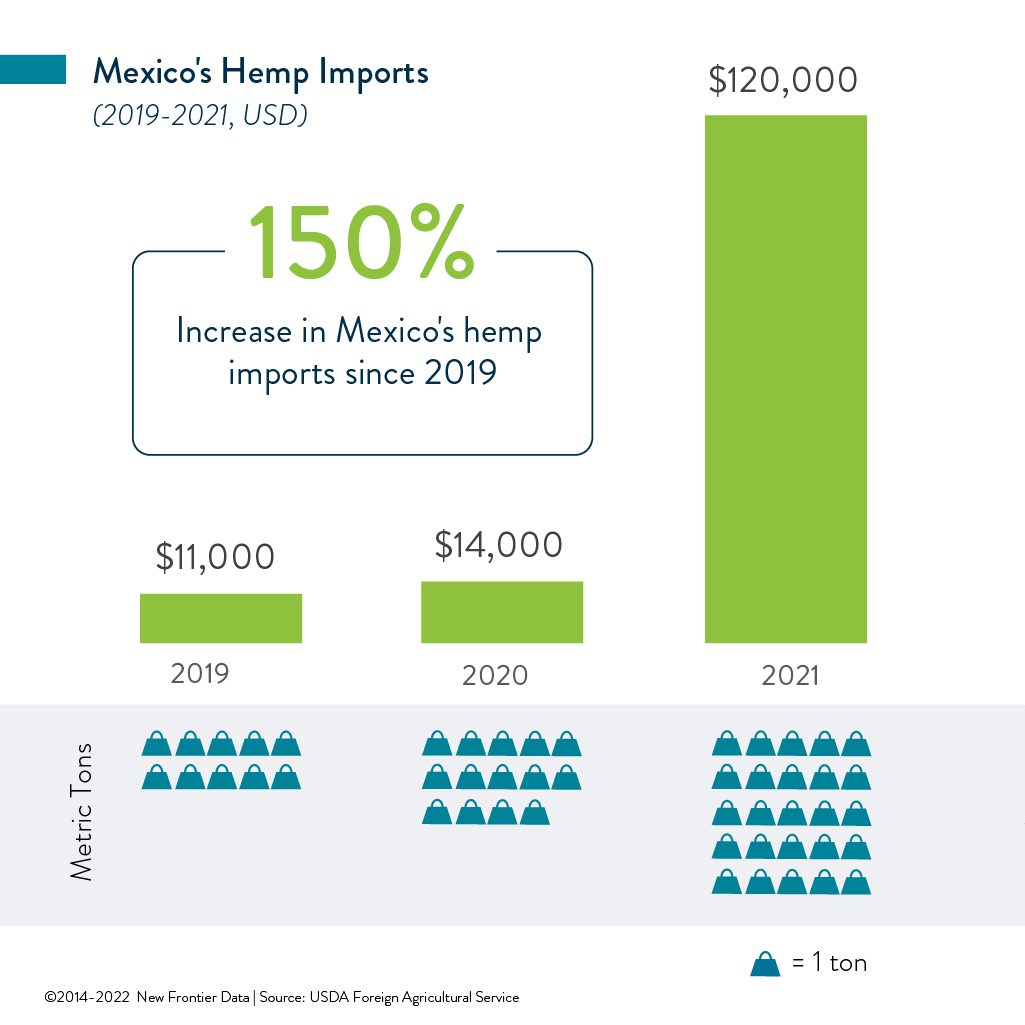

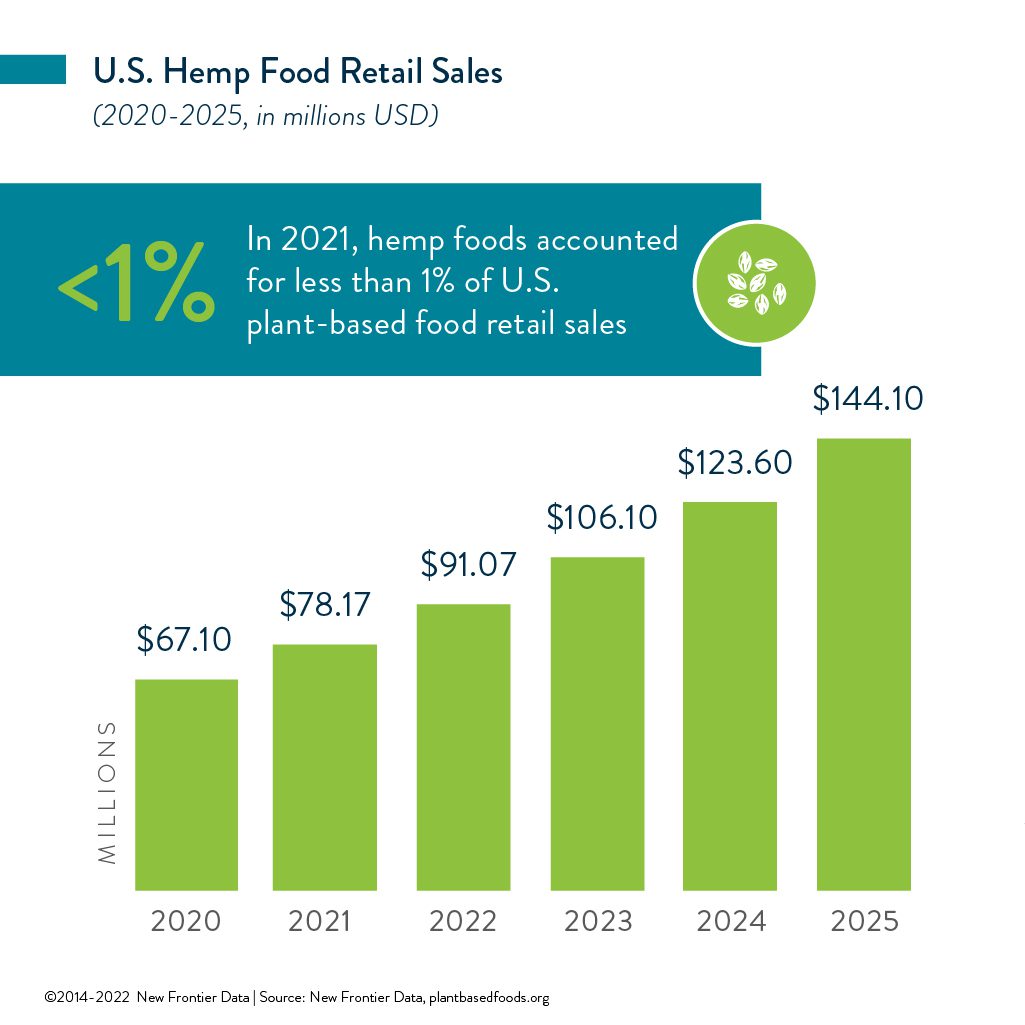

New Frontier Data estimates retail sales for hemp food products having reached $78.17 million in 2021, conservatively growing to $144.1 million by 2025 (a 16.5% CAGR).

Beyond the plant-based category, the rich nutritional value of hemp grain suggests its wide applicability as an ingredient in a vast array of staple consumer-packaged goods, including cereals, soups, or granola bars. Given the progressive nature of the plant-based foods category and its targeting of health and environmentally conscious consumers, however, hemp seems likeliest to first find a foothold within that category.

Ultimately, the success of brands like Beyond Meat and Impossible Foods spurred giants Tyson Foods and Nestlé to launch their own plant-based portfolios.

All that it takes to get Big Food’s notice is for a start-up brand or two to start diverting sales from a grocery shelf mainstay. As soon as hemp proves itself in the market as a food ingredient, Big Food will want a piece of the action. Planet Based Foods, having rolled out a line of hemp burgers in February, may prove the point: Within two months, they had already inked a distribution deal with U.S. Foods, and began selling online through Amazon.

The post Hemp’s Role in a $7.4 Billion Plant-Based Foods Market appeared first on New Frontier Data.

from New Frontier Data https://newfrontierdata.com/cannabis-insights/hemps-seat-at-the-table-for-a-7-4-billion-plant-based-foods-market/

source https://ozlemhermsen.tumblr.com/post/682832705369571328