By Oliver Bennett, Special Contributor to New Frontier Data

While the cannabis industry’s eyes may be firmly on Europe, there is another country having been long positioned in the avant-garde of cannabis, and pushing the policy agenda once again. While Israel is not itself in Europe, it is adjacent to the continent, with significant linkage to that territory as well as to the U.S. and the Middle East and North Africa, including the Gulf of Guinea and sub-Saharan regions of Africa.

Israel is already a cannabis-friendly country. Per capita, it is among the world leaders in medical cannabis consumption, with more than 100,000 Israelis reportedly having medical cannabis permits. Cannabis possession has been decriminalized since 2019 for those ages 18 and over, and possession of homegrown cannabis is no longer a criminal offense.

Since then, Israel has not taken cannabis legislation much further, and efforts to enact full recreational legalization failed in 2020. This year, however, there seems to be some movement afoot. Israel’s Justice Minister Gideon Sa’ar has introduced a revised decriminalization plan aiming to change the status of cannabis offenses from criminal to civil, while expunging criminal records. With the support of President Isaac Herzog, Sa’ar called on Israelis convicted for possessing or using cannabis to submit requests to have their records erased, allowing them to retrospectively be considered innocent, while enabling those with pending proceedings to contact the police and ask that their charges be dropped. Their announcement noted that a 2019 order was set to expire – a statute of limitations that opens the way for legal amendments to reposition possession and use of cannabis as administrative offenses. In another move, it was announced in February that Israel would no longer include CBD in its Dangerous Drug Ordinance, allowing it more latitude in both use and importation.

Israel’s arguments for cannabis liberalization – as well as legalization – have friends in high places. Earlier this year, former prime minister Ehud Olmert, who has interests in the medical cannabis industry (most notably in the shape of start-up Univo), said that as part of a group of cannabis investors he hopes to get Israel to legalize cannabis. “Everything will change dramatically overnight if there will be legalization,” he said, leading to speculation that it could happen yet this year.

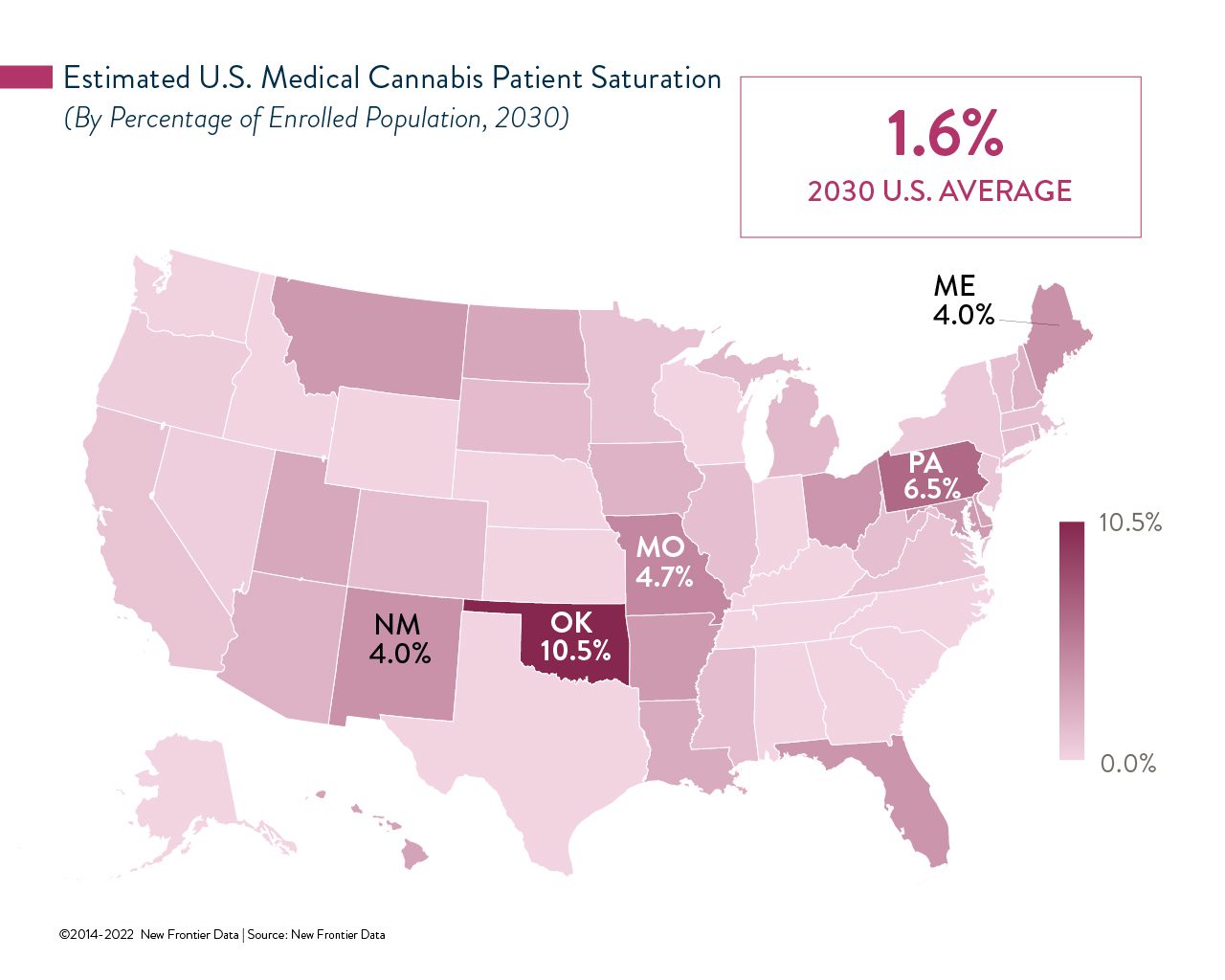

Those developments come as part of a long history of cannabis leadership in Israel. As available to review via New Frontier Data’s cutting-edge Equio platform, medical cannabis has been legal in Israel since the late 1990s; since the allocation of the first domestic licenses in 2006, the country has developed into a world-renowned cannabis R&D hub. Now the country has the most developed medical cannabis scheme outside of North America. Over 0.6% of the Israeli population is currently registered as users; in contrast, Germany – Europe’s leader for cannabis-based treatments – has a penetration rate of under 0.15%.

Israel has a strong biotech sector in general, which has prompted it to take cannabis seriously. Nationwide, 31 companies have been permitted to grow medical cannabis for 88,000 authorized patients, with five more producers authorized to process and manufacture medical cannabis products, according to the Israeli Medical Cannabis Agency. Dry flower dominates Israel’s medical cannabis program, and is likely to remain the medical model for the foreseeable future.

Indeed, Israel has a reasonable claim on being the historic global leader in cannabis research. THC’s discovery in the early 1960s by Israeli Professor Raphael Mechoulam is often cited as the key milestone for global cannabis research. That was followed in 1992 by the similarly significant discovery of the endocannabinoids system, courtesy of, among others, the eminent Professor Lumir Hanus.

Since those findings, Israel has sought to remain at the forefront of cannabis research while gaining headlines in the process. In 2020 Israeli scientists launched clinical trials to learn whether cannabis might be efficacious in stopping the spread of the COVID-19 coronavirus, while more recent trials between Soroka University Medical Center and the Israeli medical cannabis company Cannbit-Tikun Olam showed promising results for the treatment of post-traumatic stress disorder (PTSD).

Comparable to European efforts, Israel is also putting a domestic emphasis on business and job creation. In the Negev Desert, the town of Yeruham is growing a reputation as Israel’s powerhouse for medical cannabis technology, with lots of start-ups working on medical cannabis production. Efforts are being led by the incubator firm CanNegev, which is aiming to foster a creative cluster of cannabis companies.

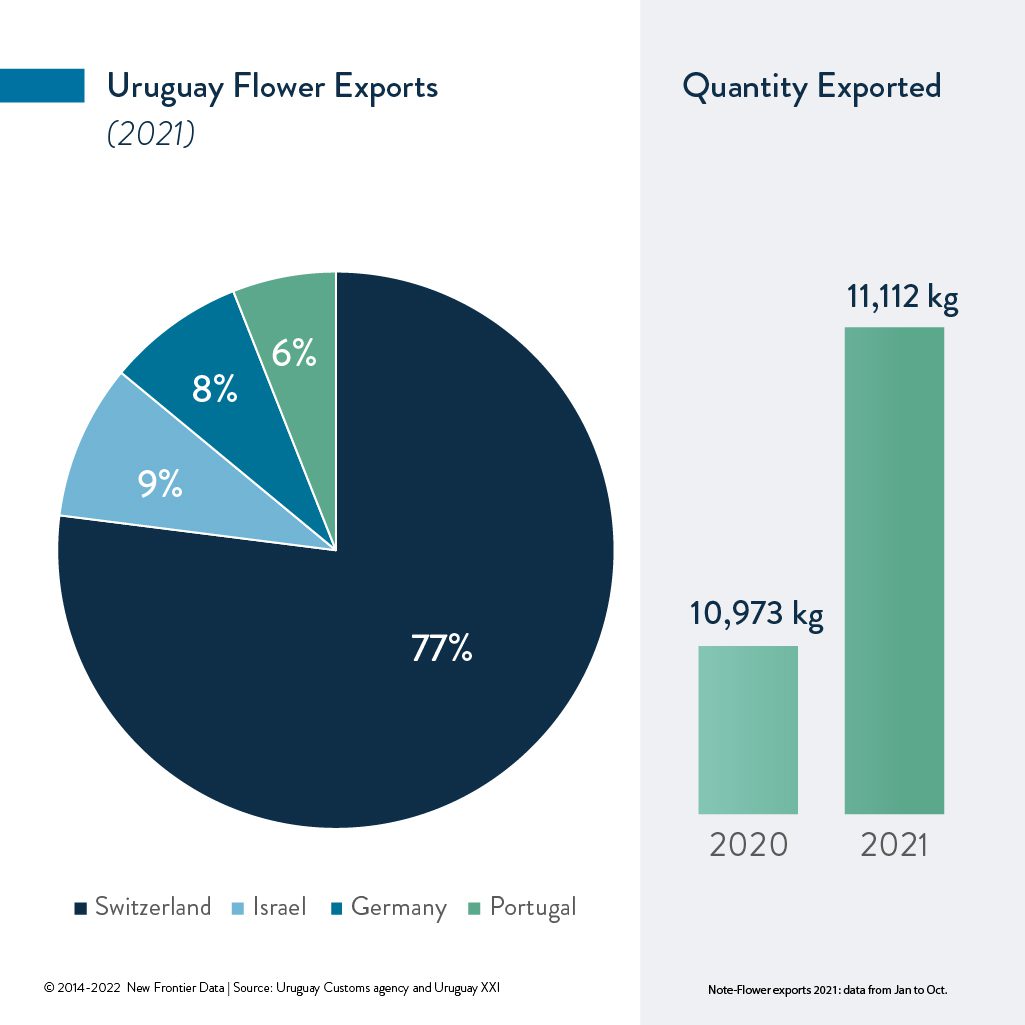

Israel is involved in imports and exports to Europe with a thriving exchange of ideas and products. For instance, the large Israeli pharmaceutical chain Super-Pharm is set to import Portuguese producer Agrivabe’s Miracle Alien Cookies cannabis strain to sell as Cannavix Miracle. That brings Super-Pharm’s range of medical cannabis to about 200 different strains, and will bolster Israel’s educational retail approach with workshops and pharmacist training.

There are other recent cannabis firsts in Israel to illustrate the country’s general thinking. Tikun Olam is said to be the first American-style, stand-alone cannabis dispensary in Israel, while a medical cannabis café called Smokey Monkey (based in Tira), is the first such café where people can buy and use medical cannabis to treat themselves for more common conditions, including pain. Notably, the cafe is close to the Green Line demarcation border between Israel, Jordan, Egypt, and Syria.

Israel is pushing to expand R&D for specific conditions. Cannabotech recently released a study revealing the effectiveness of CannaboBreast medications for breast cancer – a potential treatment to be combined with more orthodox chemotherapy against the biological and hormonal processes of the disease. The Israeli company Gynica is working on cannabis-based treatments for women dealing with painful menstruation or intercourse, while last year medical cannabis giant Panaxia began exporting its medical cannabis vapes to Germany – the first country to gain approval to legally market a cannabis product in Europe. As European markets develop, Israel is certainly to remain a significant peripheral player.

The post Geography Aside, Israel Is a Player in Europe’s Cannabis Markets appeared first on New Frontier Data.

from New Frontier Data https://newfrontierdata.com/cannabis-insights/geography-aside-israel-is-a-player-in-europes-cannabis-markets/

source https://ozlemhermsen.tumblr.com/post/680103575478779904