By Eric Singular, Director, Hemp Business Journal

When considering the growth and maturation of the U.S. hemp grain market, it would be foolhardy to ignore lessons learned from Canada over the past 20 years. For the better part of two decades since legalizing industrial hemp production in 1998, America’s neighbor to the north has commanded the global market for hemp foods.

When the U.S. legalized hemp in 2018, early movers were overwhelmingly focused on the business of hemp extraction. The promise of CBD has been the driving force behind the cultivation, processing, and marketing of hemp-based products in the U.S., with the lion’s share of U.S. acreage committed to cannabinoid production.

Yet for many growers and industry operators, the promise proved short-lived when oversupply sent CBD biomass prices crashing in 2019. Prices have yet to recover, and the growth of the retail CBD market has underperformed estimates, in part due to a lack of a regulatory framework promulgated by the U.S. Food and Drug Administration (FDA). In Q3-2021, Charlotte’s Web reported revenues of $23 million, down year-over-year from Q3-2020’s revenue of $25 million. In addition, CV Sciences reported $5.1 million in sales for Q3-2021, down 8% from $5.6 million in Q3-2020.

Four years since the U.S. legalization of industrial hemp, interest is turning toward hemp fiber and grain, while sorely needed infrastructure is finally finding its footing. Canada has seen its fair share of ups and downs in the industrial hemp market over the last 20 years (particularly for grain), and U.S. operators would be wise to heed those lessons.

In its 22-year existence, the Canadian hemp industry has largely ignored hemp-derived cannabinoids. Rather, Canadian operators like Manitoba Harvest (which was founded the same year that hemp was legalized) have cultivated a robust supply chain from seed to shelf for food products made from hemp grain. For years, Manitoba Harvest has been at the forefront of the global hemp grain market, with New Frontier Data estimating that the company commanded 58% of retail sales for hemp food products in 2020.

Fluctuations in Canada’s annual hemp acreage are broadly shaped by Manitoba Harvest’s retail sales to keep production balanced with consumer demand. In 2019, Manitoba Harvest was acquired by Tilray for $317 million; at the time, their products were available in approximately 13,000 U.S. stores and 3,600 Canadian outlets.

New Frontier Data spoke with Manitoba Harvest’s Pedigree Seed Production Manager/Agronomist, Darrell McElroy, and its Director of Farm Operations, Clarence Shwaluk, to discuss both the history of Canada’s hemp grain market and the forces shaping the upcoming 2022 production season.

Both are veterans of the Canadian hemp industry. While their optimism has at times wavered since the legal market opened, they maintain optimism for exponential growth in the hemp grain market during the years and decades to come.

Balancing supply and demand

Among the tried-and-true givens in agriculture is that farmers are always chasing demand. One year, a shortage or undersupply of a certain crop will fetch a premium, while the next year will see prices for the same crop fall sharply as opportunistic farmers hope belatedly to jump on the bandwagon, if instead just overproduce, causing an oversupply.

McElroy and Shwaluk recount three specific gluts in Canadian hemp production that crashed the market and caused growers to sell grain for bird seed, at substantial losses.

The first was in 2000, after two explosive years of market growth. In the fall of 1999, the Drug Enforcement Administration directed the U.S. Customs Service to stop the importation of hemp seed products to the U.S. The first seizure was a 53,000-pound load of sterilized seed (from Kenex, Ltd., Canada’s largest producer of hemp food) intended for sale as birdseed. The second glut came after overproduction in 2006, as growers sold their stockpiles to the European birdseed market at a huge loss, e.g., about $0.20 per pound compared to the typically expected $0.50-$0.60 rate which conventional hemp grain historically fetched.

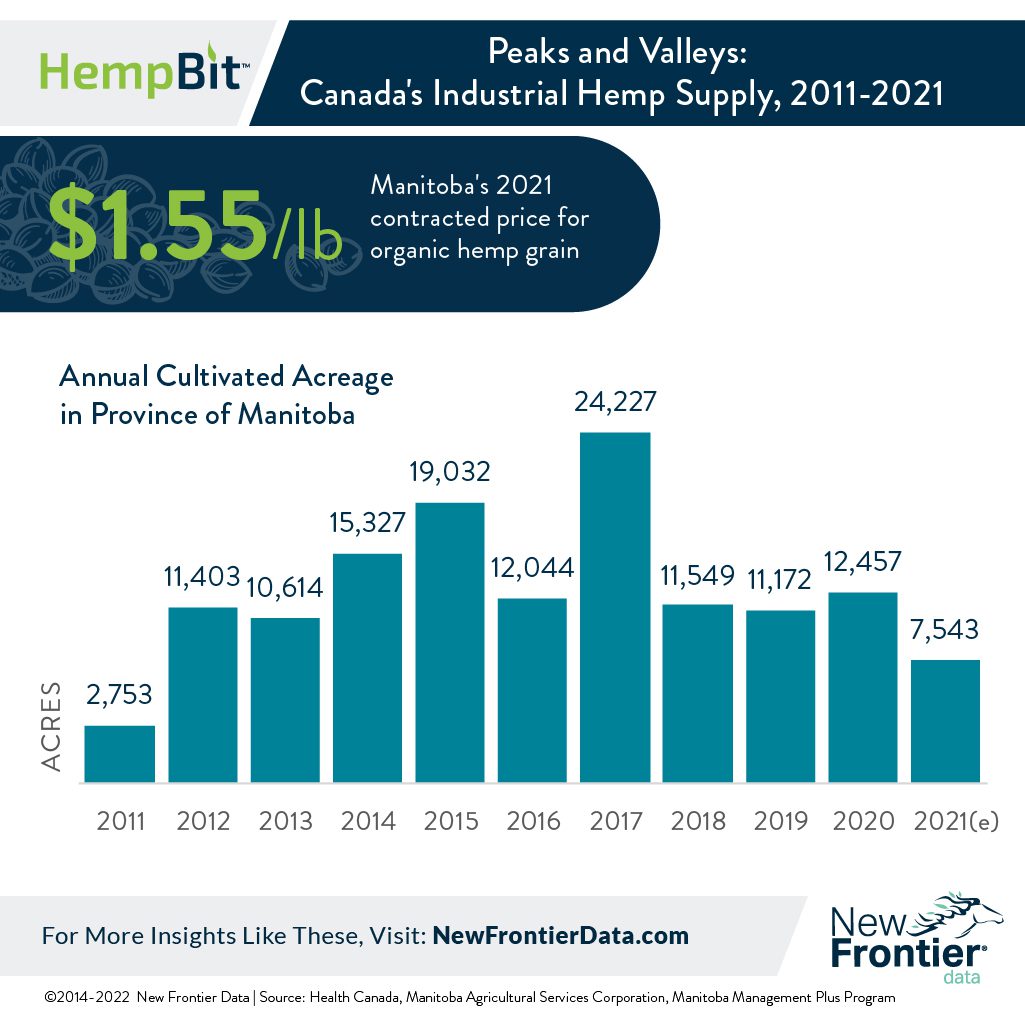

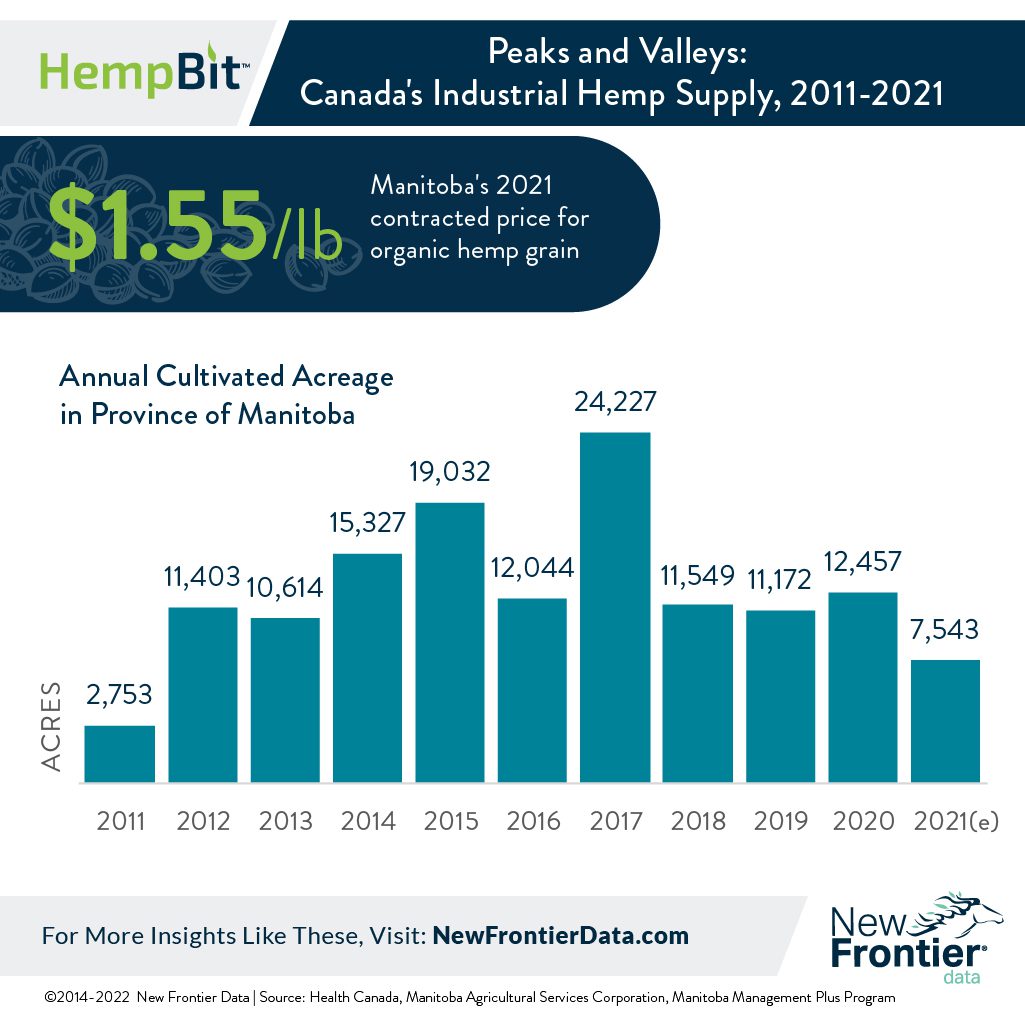

Most recent was the glut which followed South Korea’s purchasing close to 40% of Canada’s export crop in 2016. Fueled by that enthusiasm, Canadian growers in 2017 produced the most hemp acreage since its legalization, with growers in the Province of Manitoba planting 24,227 acres (up more than double from 12,044 the prior year), Canadian exports to South Korea subsequently fell 27%, as China undercut and displaced the Canadian supply with a lower price which crushed the market, taking the North American market years to exhaust the oversupply.

From 2018-2020, that oversupply kept prices low (going for an average of $0.50-$0.55/pound for conventional hemp grain), though the tide has at last seemingly turned, with prices for hemp grain on the rise. According to the province’s agency of Agriculture and Resource Development, the contracted price of conventional hemp grain in 2020 ranged from $0.75-$0.84 per pound. Generally, organic grain fetches a 30-40% premium above the conventional commodity.

Market growth has plateaued

Early on in Canada’s hemp industry, some believed that it would become a standard farm crop, alongside canola. While there have been periods reaching a consecutive compound annual growth rate (CAGR) between 25%-30% (most recently during 2014-2016), McElroy and Shwaluk note that the market has largely plateaued in the past five years. In 2021, Canadian farmers planted 22.5 million acres of canola, compared to approximately 60,000 acres of industrial hemp. They say that consumer education is still vital for increasing demand for hemp-based food products, but are quick to call out the challenge of food inflation. According to the latest Consumer Price Index data, food prices rose 6.1% between November 2020 and November 2021, greatly affecting choices for consumers at the grocery store. McElroy and Shwaluk conclude that typical purchasers of Manitoba Harvest’s hemp hearts may be prioritizing staple food products like milk during the inflationary period.

High agricultural commodity prices

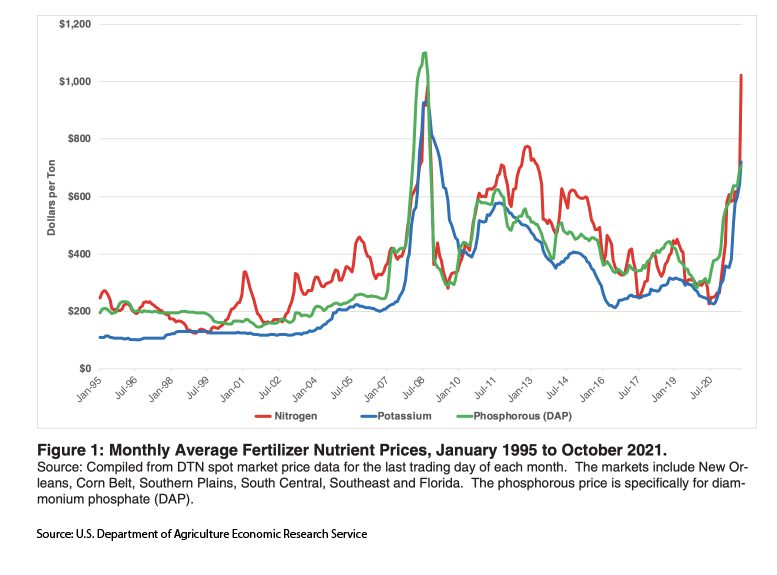

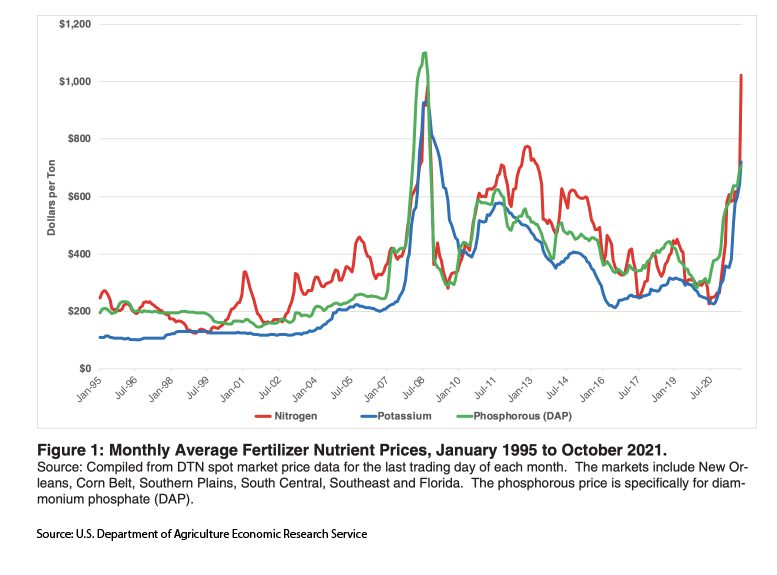

In the winter of 2020, canola was fetching about $12 per bushel. By November 2021, prices reached nearly $20 per bushel. In addition, farm inputs like fertilizer have seen tremendous price spikes throughout recent months. A report from Texas A&M’s University Agricultural and Food Policy Center (AFPC) estimates nitrogen prices at nearly 81% higher for corn farmers in 2022, averaging $52.07 more per acre in nitrogen costs while coming on top of a 200% year-over-year spike in fertilizer costs. Consequently, corn farmers will need to collect $0.32 more per bushel in order to offset the higher nitrogen price.

The market demand for organic crops

McElroy and Shwaluk report that retail market demand is shifting heavily to organic hemp foods products. Manitoba Harvest offers both conventional ($0.63/oz.) and organic ($0.83/oz.) hemp hearts. With demand favoring the organic, McElroy and Shwaluk expect 70% of their 2022 contracted acreage with growers to be dedicated for organic production.

In 2021, Manitoba Harvest contracted organic hemp grain production at $1.55/pound, a premium up from $1.00-$1.25 in years past. McElroy and Shwaluk share another challenge in securing 2022 organic acreage: Some Canadian organic farmers are transitioning back to conventional production because of rising agricultural commodity prices, since conventional crops now fetch the premiums once reserved for organic crops.

According to McElroy and Shwaluk, Manitoba Harvest annually contracts an average of 35,000-40,000 acres. While Manitoba Harvest has contracted production with growers in the northern U.S. since hemp was legalized in 2018, greater demand to secure organic acreage may see more American farmers able to integrate with the Canadian hemp grain supply chain.

Processing capacity

An estimated 20 million-25 million tons of Canadian grain were processed in 2021, according to McElroy and Shwaluk. They believe that the capacity of the Canadian hemp grain industry could accommodate closer to 30 million-40 million tons yearly. Meanwhile, they posit that rising interest in Canadian hemp fiber production could require an additional 35,000-40,000 acres, nearly doubling the country’s total hemp acreage.

The question is how to grow the market to at least meet the country’s existing processing capacity. McElroy and Shwaluk can’t overemphasize the importance of consumer education. For them, the battle for shifting the public perception of hemp from drug to food is one that’s been ongoing for twenty years. They admit that when hemp gets clumped in with marijuana, whether in regulatory matters or marketing campaigns, it is unavoidably problematic.

“Maybe we should stop calling hemp a superfood,” they joke. Instead, we should start thinking about how hemp grain byproducts as ingredients that can be used to boost the nutritional value for a vast array of food products (without necessarily marketing the product as “hemp-based”). That is how North American hemp production could reach the milestone of a million acres, catapulting hemp from a cottage industry toward achieving status of a staple agricultural commodity. Otherwise, as noted by McElroy and Shwaluk, the market for hemp food products on grocery shelves has largely plateaued.

Manitoba Harvest is hard-at-work getting hemp grain into the hands of big food manufacturers as a plant-based protein and nutrition-packed ingredient. That seems the way toward the most fruitful next decade for the North American hemp grain market.

The post Canada’s Lessons for North America’s Hemp Grain Market appeared first on New Frontier Data.

from New Frontier Data

https://newfrontierdata.com/cannabis-insights/canadas-lessons-for-north-americas-hemp-grain-market/

source

https://ozlemhermsen.tumblr.com/post/673957994663444480